Wichita is the most populous city in Kansas, which means there are plenty of risks that come with living and driving here every day.

One major challenge when shopping for insurance in Wichita is simply the number of other drivers on the road. It might sound obvious, but more drivers can mean higher car insurance rates—and a bigger hit to your wallet. Other factors, like crime rates and annual accidents in your ZIP code, also play a role.

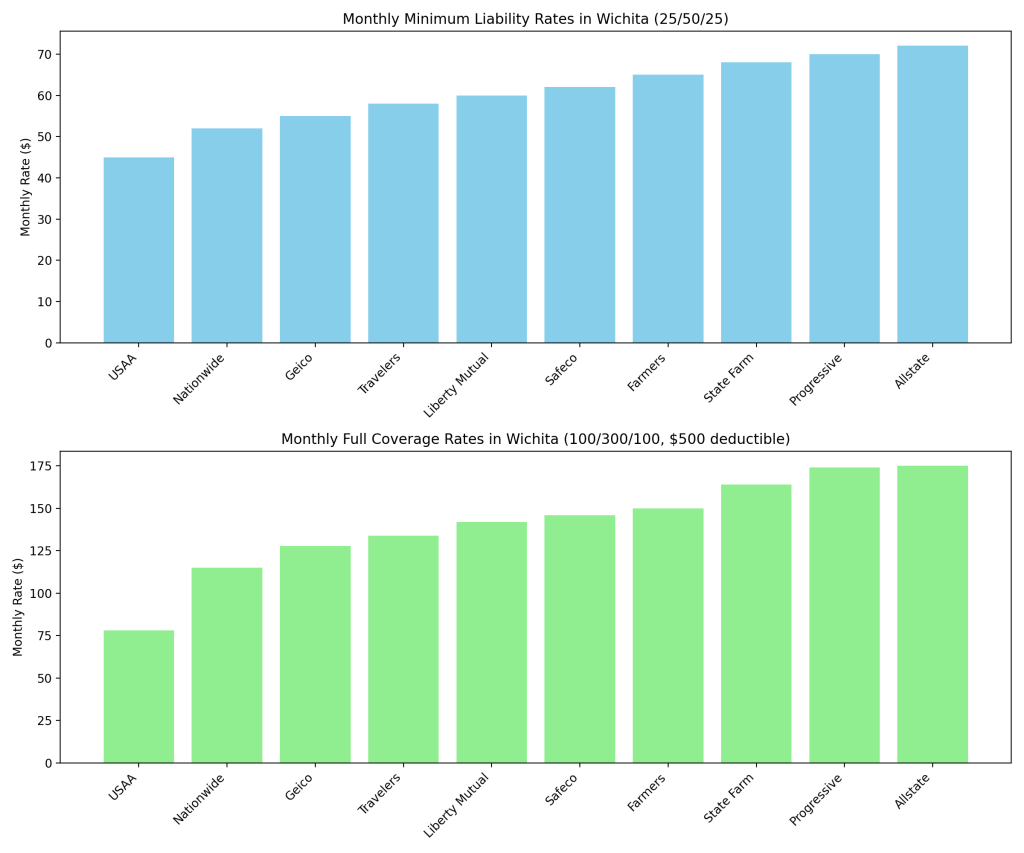

All of this can make shopping for car insurance feel overwhelming, especially if you’re collecting quotes from individual carriers one by one. That’s why I’ve put together a couple of graphs to give you a sense of what the top 10 carriers in the area might charge. Of course, these aren’t guarantees—you’ll need to get quotes directly from the carriers to know your exact rate.

The first graph covers liability-only policies. The second shows high-limit full coverage options. (For more on the differences, check out my other article: What’s the Difference Between Liability Only and Full Coverage?

Insure.com: Average car insurance cost in Wichita, KS

Bankrate: Average Cost of Car Insurance in Kansas for 2025

Insurify: Cheapest Car Insurance Quotes in Wichita, KS for 2025

US News: Best Cheap Car Insurance in Kansas

MoneyGeek: Average Cost of Car Insurance in Kansas

As you’ll see, premiums can vary widely depending on the company. Generally, USAA is the cheapest if you’re military-affiliated, while Allstate tends to be on the higher end.

Personally, I recommend using an insurance broker to shop around for you. But if you’re set on comparing companies yourself, this is a great place to start.

Looking for information about which carriers might fit your needs more specifically? Check out my article: Choosing the Right Car Insurance.

Leave a comment